There’s a lot of confusion when it comes to business financing options as financing services companies can get creative with the names they use to describe the types of financing they offer. Part of that is for a good reason. Not all small business owners know what kind of financing they want or need especially when banks don’t come through.

Because of this, financial services companies use simple terms such as flexible funding or flexible financing. Invoice financing, accounts receivable financing and MCA funding mean little to business owners. Small businesses know they need working capital to help with cash flow. Here are the common terms to help you navigate the murky waters of financing.

Accounts receivable (AR): Money owed by clients to a business in exchange for services performed or products provided.

Accounts receivable financing: Companies sell their outstanding invoices to a financial services organization at a discounted rate. The amount comes from confirmed sales orders and accounts receivable. The funding is based on the company’s amount of accounts receivable. The financial services company pays for the invoices and takes over the risks associated with the receivables. This is also known as accounts receivables funding, factoring and accounts receivables factoring. See factoring.

Angel investor: Also referred to as private investors, angel investors are individuals who invest in a business with their own money. They do it because they want to support innovation or the entrepreneurial spirit. Or they’re passionate about the start-up product, service or the company’s leaders. Investment from angels work best for businesses expecting a few millions of dollars in revenue per year. These loans range from $25k to $75k.

Balance sheet: Provides a snapshot of assets, liabilities and ownership equity within a single point in time. A balance sheet takes the temperature of the company’s financial health.

Cash flow: Cash flow is how money comes in and out of the business. Cash comes in a company through financing, operations and investments. Cash goes out of the company through expenses and investments.

For example, your phone bill is due on the first day of every month. You want to be sure to have cash available for that bill. Understanding how and when cash comes in and goes out ensures your company remains solvent or else face bankruptcy.

Credit cards: Provides customers with a cash advance like a line of credit for purchases and other expenses. Customers pay a partial or full amount to the issuer by a due date. Paying the credit card in full prevents being charged any fees. Partial payments usually come with fees. Fees vary depending on the credit card issuer.

Here are some types of fees associated with credit cards:

- Annual fee: Some credit cards come with privileges in exchange for a yearly fee, and some don’t offer anything. You can try requesting a waiver of the annual fee or you may not need to pay an annual fee if you make enough purchases with the credit card.

- Application fee: A one-time fee paid when applying for a credit card. You could keep looking for a credit card without an application fee or request a waiver.

- Balance transfer fee: Credit card companies encourage transferring a current credit card balance to theirs. However, beware some charge a fee for this process. Work around the fee by paying off your old card and starting fresh with the new one or request a waiver in exchange for the company getting your business sooner.

- Cash advance fees: These credit cards work with ATMs for easier access to cash. The downside is that they add a fee for the service. It’s possible the card comes with a minimum fee, a fee on the amount you take out of the ATM or interest charges.

- Convenience checks: Credit card companies send blank checks with your account information to be used like checks. Instead of the cash coming out of your bank account, it goes on your credit card. These checks could come with a fee for using them or for returned checks. They might also have a minimum.

- Foreign transaction fee: In preparation for travel, find out from your credit card issuer if they charge extra for using the credit card in foreign countries. If you travel often, you might consider finding a special credit card that doesn’t have foreign transaction fees or seek another payment option.

- Late payment fee: This fee shows up on a credit card statement when the user missed a credit card payment due date or didn’t pay the minimum amount.

- Merchant surcharges: Merchants may pay a fee for credit card transactions. Rather than absorbing these fees, they have their customers pay the fee with the merchant surcharge.

- Over the limit fee: When customers exceed their credit card’s limit, the credit card issuer may charge a fee for going over the maximum. Make sure your credit card balance has some room to breathe and keep in mind that some charges may not have come through when you check its balance.

Factoring: An accounts receivable is money a company is owed after having performed the service or provided the product. In other words, the client owes money to the company. With factoring, a business works with a factor who buys your accounts receivables for less than the full value.

For example, a company has an accounts receivable for $100. Some factors pay $75 and take over the invoice along with the risk of nonpayment. Though the company loses all or part of the $25, it doesn’t have to wait 30, 60 days or more to see the cash. It lets the company get the money faster and reinvest it to grow the business. It’s a way to get paid without waiting on the customer.

Financial services organizations: Financial services organizations provide financial services and may be more flexible than banks. They have different loan and funding qualification requirements than banks do. Some financial services organizations simplify paperwork and provide cash faster than a bank. They may or may not require companies to put up collateral to get funding or a loan and interest rates vary. The type of funding they provide depends on what they offer. It could be factoring, accounts receivables financing, merchant cash advances or microloans.

Income statement: The income statement — also known as profit and loss (P&L) statement — shows the amount of money that flows in and out of the business. It helps a business to see where it has been, where it is now and where it is heading. These statements cover a timeframe so you can compare the previous month’s and current month’s statements. You’ll know how the business is doing and whether profits went up or down.

Line of credit or business line of credit (LOC): Process of receiving money from a financial services company for short-term needs. The business pays interest only on the funds taken out. A line of credit works like a checking account where the business has a set amount of money in an account and can write checks as needed to cover expenses including salaries, vendor invoices, inventory and more. A line of credit generally doesn’t require putting up collateral, or assets such as equipment and buildings.

Merchant cash advance (MCA): Also referred to as merchant cash funding, business cash advance and small business loan, MCAs collect a percentage of a business’ daily credit or debit card sales until the MCA has recovered the amount they advanced, APR and their fees. For B2B companies that don’t use credit or debit cards, MCAs collect money through daily bank withdrawals.

Micro loans: These are small loans that tend not to exceed $50k.

Peer-to-peer loans: Loans from colleagues and family or online loan sites. While you can shop around for bids, these may not offer protection. Interest rates vary.

Profit and loss (P&L) statement: See income statement.

Short-term loans: A short-term loan consists of an extended credit from a bank and comes with a fixed repayment period and interest rates. These loans usually last no longer than one year and some require collateral.

Venture capital (VC): An organization or institution that invests large sums into a business. Start-ups needing millions of dollars of investment and plan to grow on a large scale tend to use VCs.

Working capital: The working capital is the amount left when you subtract a business’ current liabilities from its current assets. A positive working capital allows the company to pay its short-term liabilities. A negative working capital — where a company’s current liabilities is higher than its assets — makes it difficult for the company to pay creditors. This situation could lead to bankruptcy. Having working capital ensures a company pays its bills even while waiting for payment for sales or services it has delivered.

What other terms would you add to this list?

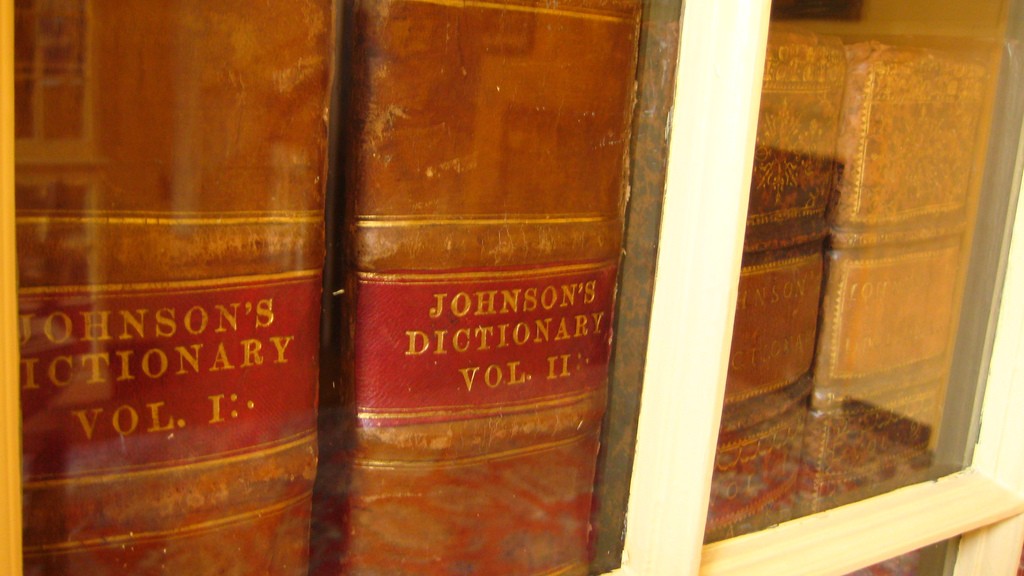

Image credit: David Woo