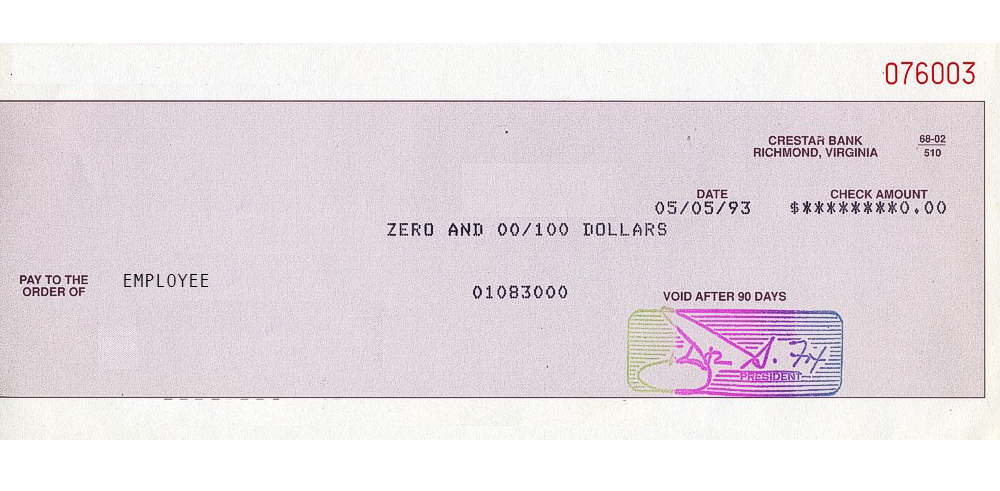

You’re a business owner and tomorrow is payday. The checks that are supposed to cover payroll haven’t come in. On top of that, you had to purchase materials with what little cash you had on hand. You just couldn’t wait until after payday to get the materials you needed.

This is a situation familiar to many small business owners. And there’s an easier way to solve it without upsetting employees, clients, and vendors.

What happens when cash flow is low?

Businesses tend to do one or some of these:

- Ask employees to hold their paychecks for a few days.

- Tell customers you have to cease purchases and delay production to collect on accounts receivables.

- Deal with upset vendors as their checks bounce and pay overdraft fees.

- Get a bank loan.

Talk about being stuck between a rock and a hard place. One client faced this dilemma.

Clearly, someone is going to be upset no matter which option he chooses. Even if he helps employees understand, delaying their paychecks would put a serious ding on morale. It would be hard to come back from that. They might start worrying about getting paid on time or at all. This could lead them to seek new jobs. Then you’ll be in a worse position in which you have to hire new people and get them up to speed.

What could he do?

The client rotated options 1, 2, and 3 for years upsetting all three groups at one time or another. No doubt, it hurt the company’s reputation. Furthermore, his company faced financial setbacks that forced him to file Chapter 11.

As for No. 4, he couldn’t get a bank loan. Even if he could, it would not come through fast enough.

How you can stop dealing with cash flow problems

This prompted him to investigate getting financing on his accounts receivable through factoring. He shopped around for companies that provided the service. Every factor — except one — required that he submit all of his accounts receivable.

Then he came across Capital Solutions Bancorp. (That would be us.)

He liked that CSB would allow him to choose which customers’ invoices to submit for financing. In fact, he didn’t have to submit all invoices from a single customer. It could be one invoice or four. Or he could submit one invoice and never submit another again.

Factoring helps cash flow and growing your business. With CSB’s flexible financing, the business has complete control over cash management and expenses. They’re not at the mercy of banks and their requirements.

Once he started using accounts receivable financing, his relationship with employees, vendors, and customers improved.

“But what has kept us with Capital Solutions Bancorp is not only their competitive edge but their wonderful staff,” he wrote. “When our customers aren’t paying on time but we must still continue to cut checks, it can just feel like everything is falling apart and it makes me want to yell and scream and fight with everyone … but then there’s a friendly voice to help calm me down and give me those words of encouragement, ‘We’re on it, money is on the way!’”

Accounts receivable financing made it possible for one small business owner to enjoy the holidays without worrying about money for the first time in 26 years.

The side effects of cash flow problems

You might be thinking that you can just keep going with the way things are. When you don’t have cash when you need it … this is what can happen:

- Clients switch to a competitor that gets the job done on time.

- Your attention is split between chasing payments and managing business.

- Employees leave for new jobs that won’t have them worried about paychecks.

- Your health isn’t optimal because of the stress from dealing with cash management.

- Vendors stop serving you or increase rates for late payments.

- You spend more time at the office instead of with family, even on holidays.

Take a moment.

Clear your mind of everything.

Picture how things would be if you have the cash when you need it. How is it different from your life today? More peaceful? More time for growing business and family?

How can you go from here to there?

Factoring.

How factoring works

Unlike a bank loan or merchant cash advance, you don’t pay anything back with accounts receivable financing. This approach simply gets the money you’re owed faster.

Factoring has two big benefits: instant payment and zero debt.

When your business has the money it needs at the right time, you can pay your bills, purchase needed items, and make payroll. You don’t put your relationship with clients and vendors in jeopardy. And your employees won’t start looking for jobs.

Like with any financing plan, factoring involves fees. Unlike with a small business bank loan and MCA, you don’t shell out to pay those fees. They’re subtracted from the amount the factor pays for your invoices.

Factoring can be flexible if you work with the right factor. As you saw in the client’s story, most factors require you to fund all of your invoices or all invoices from a single customer through them. Working with a company like ours, you decide which invoices you want to submit. It can be one and done. Or on an as-needed basis.

You can be doing a lot of things right and run into cash flow problems. Many businesses with plenty of clients have struggled or filed Chapter 11 because they couldn’t get a handle on cash flow. Here are five things that can cause cash flow problems.

Regain control. Finance your invoices with factoring.

Image credit: James Allenspach