Have you heard about payday loans? Chances are good you’ve heard nothing good about them. They trap customers in an endless debt cycle. You wouldn’t dare, right?

Have you heard about payday loans? Chances are good you’ve heard nothing good about them. They trap customers in an endless debt cycle. You wouldn’t dare, right?

You’re a business owner and tomorrow is payday. The checks that are supposed to cover payroll haven’t come in. On top of that, you had to purchase materials with what little cash you had on hand. You just couldn’t wait until after payday to get the materials you needed.

This is a situation familiar to many small business owners. And there’s an easier way to solve it without upsetting employees, clients, and vendors.

Messages from clients like the following are why we love what we do.

“I was telling my employees that this is the first time in 26 years that I’m going to be able to relax over the holidays. There was always someone who forgot to sign the checks who left me hanging. Now I don’t have to worry anymore.”

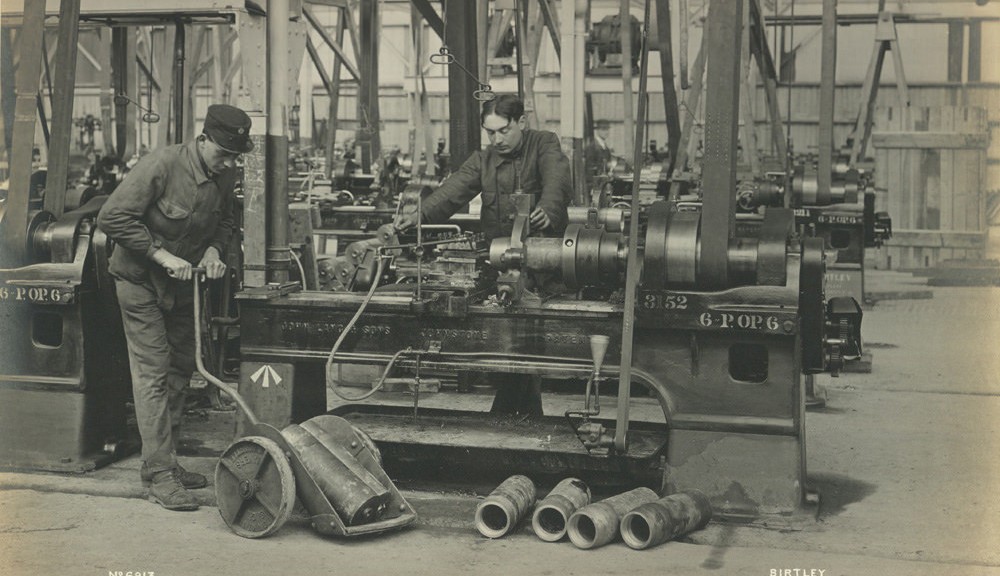

You might be looking for working capital to grow your B2B business, get a little help to pay bills, or bring costs down by buying in bulk. Like most small businesses, cash flow fluctuates in yours. It always seems to work out that when you need more cash, it’s not available.

Are you working harder than ever, but still worried about working capital for your small business? If yes, you’re probably spending a lot of time trying to track down payments. It’s a real headache to contact your clients who haven’t paid their invoices.

This is a true story. Names have been changed to protect the innocent and the guilty.

A prospect contacted me interested in my company’s services. We discussed the project and came to agreement on the scope and price.

Have you heard of payday loans? You’d never consider such an option because it’d drain your resources, right? Merchant cash advance and business cash advances are like payday loans except they target businesses.

Thousands and thousands of business owners are stuck with MCA. To attract B2B companies, some MCA providers call it Business Cash Advance. An MCA may sound like a great idea, but it isn’t when you look at the full picture of how it works.

I’ve been with my local bank since I was a teen. While opening a bank account isn’t too exciting, the exciting part was the thought of being able to write checks to pay for things. (Not anymore!) Recently, I emailed my bank contact to request a debit card who sent a friendly reply. After a little back and forth, she said she knew of me. How? I lived an hour away from the bank, so all my transactions were online or by mail.

You have many options to get working capital for your small business to ensure you have enough cash flow. Here are common questions to ask to help you find a small business lender that best meets the needs of your company.

If you are not absolutely delighted with our service within the first 30 days of funding, you can leave and get 100% of your fees refunded to you. NO QUESTIONS ASKED!