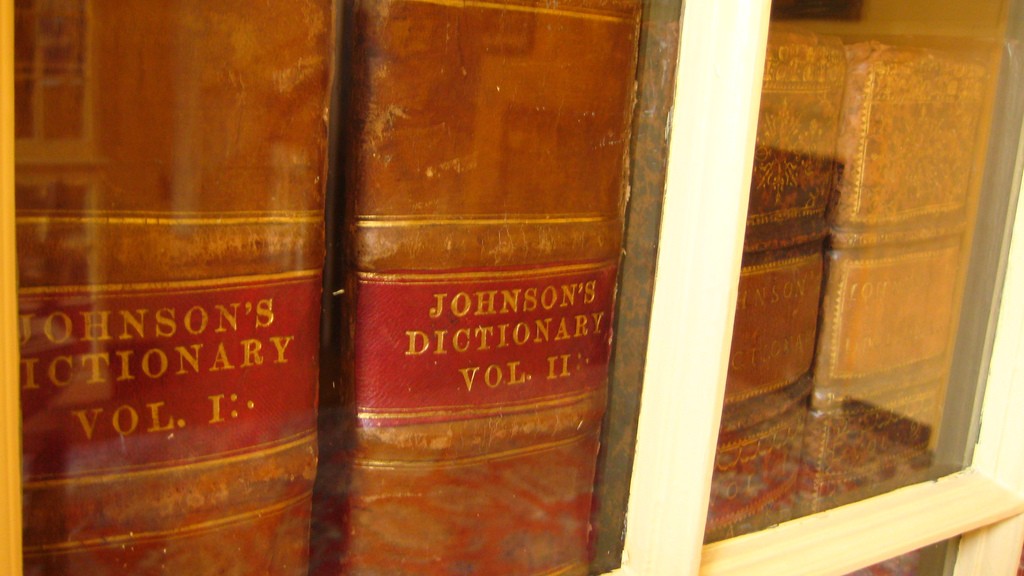

Before you consider going to a bank for a small business loan or line of credit, you might want to explore another option. A better one because it’s money that already belongs to you. The money you get from the flexible financing is invoice financing, which gives you the cash flow you need to pay expenses and grow your business. It’s also known as factoring and accounts receivables financing.

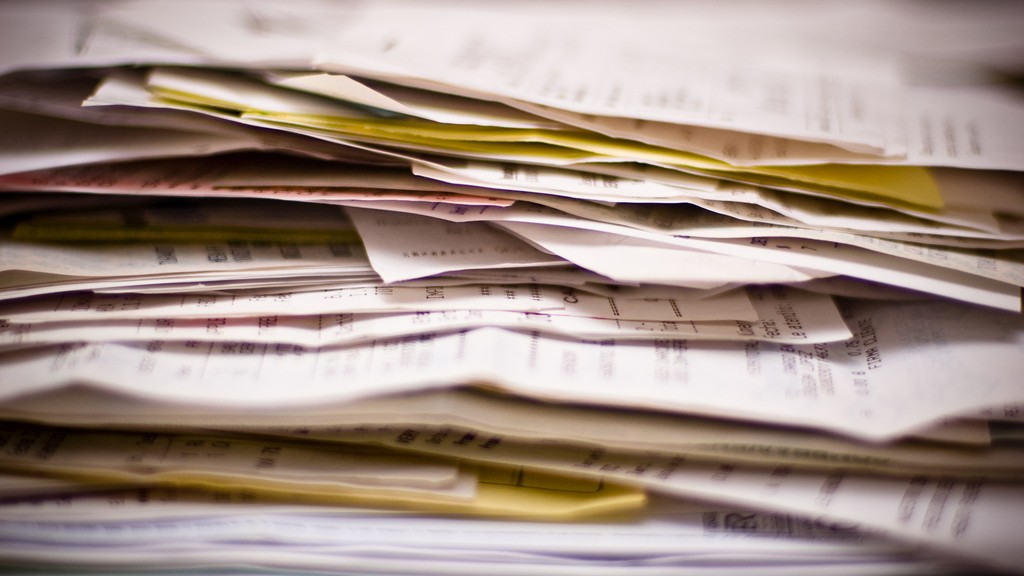

Accounts receivables are open invoices that haven’t been paid. It’s money a company is owed after delivering the product or service. Clients may take 30, 60, 90, or more days to pay the invoice. Some companies speed this process with flexible financing from a factor. The factor — a third party company — buys your invoices and gives you cash as soon as you submit them.